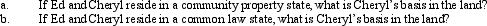

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012,when the fair market value of the land is $500,000.Under the joint ownership arrangement,the land passed to Cheryl.

Definitions:

Cash Dividend

A distribution of a company's earnings to its shareholders in the form of cash.

Passive Investment

An investment strategy involving minimal buying and selling actions, typically focused on long-term gains and avoiding frequent trading.

Common Stock

A type of security that represents ownership in a corporation and grants shareholders voting rights and a share in the company's profits through dividends.

Fair Value

The estimated market price of an asset or liability, reflecting the amount for which it could be exchanged or settled between knowledgeable, willing parties in an arm's length transaction.

Q1: Paul and Patty Black are married and

Q8: Gains and losses on nontaxable exchanges are

Q17: During the year,Green,Inc.,incurs the following research expenditures:

Q62: The incremental research activities credit is 20%

Q62: Section 1245 may apply to depreciable farm

Q85: The tax credit for rehabilitation expenditures for

Q86: Are the AMT rates for the individual

Q109: Why is it generally undesirable to pass

Q124: Eunice Jean exchanges land held for investment

Q126: An involuntary conversion results from the destruction