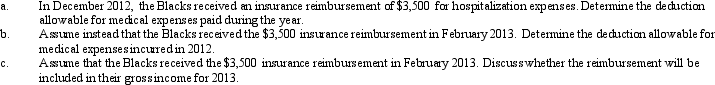

Paul and Patty Black are married and together have AGI of $140,000 in 2012.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

Definitions:

Marriage Compensation

A form of payment or gift given to the bride's family by the groom's family before, during, or after the wedding in certain cultures as part of marriage arrangements.

Dowry

A cultural practice involving the transfer of wealth, usually from the bride's family to the groom's family, as part of marriage agreements in certain societies.

First-cousin Marriage

A marriage between individuals who have one set of grandparents in common, legally and culturally accepted in some societies but prohibited in others.

Q4: Because passive losses are not deductible in

Q36: Jackson gives his supervisor a $30 box

Q50: Jackson sells qualifying small business stock for

Q58: Bill paid $2,500 of medical expenses for

Q85: Georgia contributed $2,000 to a qualifying Health

Q96: Brad,who uses the cash method of accounting,lives

Q104: Orange Corporation begins business on April 2,2012.The

Q106: On June 1,2012,Red Corporation purchased an existing

Q139: One of the major reasons for the

Q153: An inheritance tax is a tax on