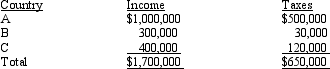

Summer Corporation's business is international in scope and is subject to income taxes in several countries.Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

Definitions:

Supply Curve

A graphical representation showing the correlation between the price of a good or service and the amount that suppliers are willing to produce and sell at each price level.

Quantity Demanded

The aggregate quantity of a product or service that buyers are ready and able to buy at a specific price point during a certain timeframe.

Quantity Supplied

The sum total of a product or service that manufacturers are ready and capable of offering for sale at a particular price during a defined timeframe.

Oropharynx

The middle part of the throat behind the mouth, which includes the back one-third of the tongue, tonsils, and soft palate.

Q16: Summer Corporation's business is international in scope

Q21: Using the choices provided below,show the justification

Q40: Which of the following is not a

Q46: For disallowed losses on related-party transactions,who has

Q85: Which of the following factors should be

Q88: Ahmad owns four activities.He participated for 120

Q96: A landlord leases property upon which the

Q118: Under what conditions is it permissible,from an

Q119: Your client,Connie,won $12,000 in a football office

Q150: The formula for the Federal income tax