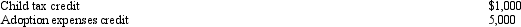

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Digital Divide

A term that refers to the gap between individuals, households, businesses, and geographic areas at different socioeconomic levels with regard to their opportunities to access information and communication technologies (ICTs).

Internet Access

The ability to connect to the web using computers or other devices to communicate, browse, and access online content.

Rural Families

Households living in rural areas, often characterized by agricultural lifestyles, lower population density, and greater distances from urban centers.

Learning Management System (LMS)

A software application for the administration, documentation, tracking, reporting, and delivery of educational courses, training programs, or learning and development programs.

Q9: Individuals can deduct from active or portfolio

Q10: Sergio was required by the city to

Q23: Paul,a calendar year married taxpayer,files a joint

Q32: Durell owns a construction company that builds

Q49: Phillip developed hip problems and was unable

Q65: Which of the following is a characteristic

Q69: An exchange of two items of personal

Q73: The portion of the office in the

Q120: Susan generated $55,000 of net earnings from

Q120: Provisions in the tax law that promote