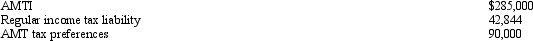

Caroline and Clint are married,have no dependents,and file a joint return in 2012.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Mid-Level Area

A segment or section that is considered neither high nor low within a structured hierarchy or spatial configuration.

Blind Area

refers to information about oneself that others are aware of but the individual is not.

Behavior Modification

A technique for altering human behavior through systematic reinforcement or punishment.

Social Learning Theory

A theory that posits people can learn new behaviors and attitudes through observation, imitation, and modeling from others within a social context.

Q20: In the current year,Louise invests $50,000 for

Q27: Briana lives in one state and works

Q50: A taxpayer may qualify for the credit

Q54: Why is there no AMT adjustment for

Q62: Is it possible that no AMT adjustment

Q75: If a taxpayer files early (i.e.,before the

Q79: When a taxpayer has purchased several lots

Q85: Sage,Inc.,has the following gross receipts and taxable

Q96: A landlord leases property upon which the

Q106: Harry and Sally were divorced three years