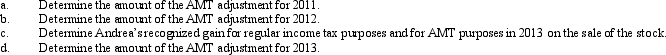

In May 2011,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2012.Andrea exercises the options in November 2011 when the stock is selling for $1,600 per share.She sells the stock in December 2013 for $1,800 per share.

Definitions:

Fee Disclosure

A practice of informing clients or customers about charges and fees for services provided, ideally in a clear and understandable manner.

Preventive Care

Medical services and practices that focus on disease prevention and health maintenance rather than treatment of symptoms or conditions.

Q23: Paul,a calendar year married taxpayer,files a joint

Q26: How does the replacement time period differ

Q29: Evan is a contractor who constructs both

Q65: During 2012,Barry (who is single and has

Q66: The exercise of an incentive stock option

Q76: Stan,a computer lab manager,earns a salary of

Q90: If a "special agent" becomes involved in

Q109: During the year,Walt went from Louisville to

Q123: The proposed flat tax:<br>A) Would eliminate the

Q147: The ad valorem tax on personal use