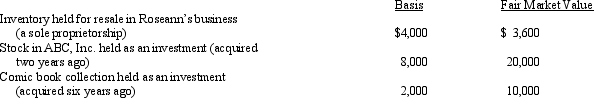

In 2012,Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2012 is:

Definitions:

Telecommuting

The practice of working from a remote location outside of the traditional office environment, often from home, leveraging technological connections.

Horizontal Communication

The exchange of information and ideas between individuals or groups at the same level within an organization, promoting collaboration and coordination.

Ethnocentrism

The belief in the inherent superiority of one's own ethnic group or culture, often accompanied by a disdain for other cultures.

Sensory Overload

A condition where one or more of the body's senses experiences over-stimulation from the environment, leading to feelings of discomfort or inability to focus.

Q2: Can AMT adjustments and preferences be both

Q18: Income from some long-term contracts can be

Q26: If a taxpayer purchases taxable bonds at

Q27: Ronaldo contributed stock worth $12,000 to the

Q30: In terms of probability,which of the following

Q31: Renee purchases taxable bonds with a face

Q36: The concept of depreciation assumes that the

Q59: Elaine,the regional sales director for a manufacturer

Q64: In determining the amount of the AMT

Q71: Kim dies owning a passive activity with