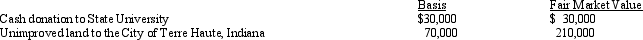

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2012:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

Definitions:

Asset Sale

The process of selling off individual assets of a company, such as real estate, machinery, or intellectual property, rather than transferring ownership of the company itself.

Asset Purchases

The acquisition of company assets, such as property, plant, and equipment, rather than the company's stock.

Liabilities

Financial obligations or debts that a company or an individual owes to others.

Enormous Liabilities

Refers to significantly large debts or obligations a person or company owes, which can impact their financial stability.

Q5: In terms of meeting the distance test

Q58: Social considerations can be used to justify:<br>A)

Q62: Alexis (a CPA and JD)sold her public

Q84: Last year,Wanda gave her daughter a passive

Q90: Rocky has a full-time job as an

Q94: Certain adjustments apply in calculating the corporate

Q98: Mallard Corporation furnishes meals at cost to

Q103: Joseph and Sandra,married taxpayers,took out a mortgage

Q111: Property used for the production of income

Q112: An election to use straight-line under ADS