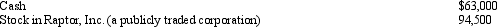

During 2012,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2012 is $189,000.What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2012 is $189,000.What is Ralph's charitable contribution deduction for 2012?

Definitions:

Demand Curve

A graphical representation that shows the relationship between the price of a good and the quantity of that good that consumers are willing to purchase.

Thin-Crust Pizza

A type of pizza characterized by its slim, crisp base, offering a crunchy texture and contrasting with thicker pizza variants.

Normal Goods

Goods for which demand increases as the income of consumers increases, assuming all other factors remain constant.

Natural Gas

A fossil fuel consisting mainly of methane, used primarily for heating, cooking, and electricity generation.

Q1: A taxpayer who lives and works in

Q36: On occasion,Congress has to enact legislation that

Q60: The earned income credit is available only

Q64: Rex and Dena are married and have

Q73: Lloyd,a life insurance salesman,earns a $400,000 salary

Q90: Identify from the list below the type

Q94: Certain adjustments apply in calculating the corporate

Q98: Mallard Corporation furnishes meals at cost to

Q108: For omissions from gross income in excess

Q114: Caroline and Clint are married,have no dependents,and