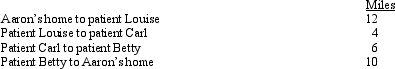

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Auxin

A class of plant hormones that regulate aspects of growth and development, such as cell elongation.

Long-Day Plant

Plant that flowers when day length is longer than a critical length; e.g., wheat, barley, clover, and spinach.

Phytochrome

A plant pigment involved in regulating various processes like germination and flowering in response to light conditions.

Pollinate

The transfer of pollen from the male parts of a flower to the female parts of the same or another flower, leading to fertilization and the production of seeds.

Q16: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q21: Nicole's employer pays her $150 per month

Q23: Which,if any,of the following expenses are not

Q35: In calculating her taxable income,Rhonda deducts the

Q56: If a taxpayer has an NOL in

Q68: Five years ago,Tom loaned his son John

Q75: Dena owns interests in five businesses and

Q88: In January 2013,Pam,a calendar year cash basis

Q89: When lessor owned leasehold improvements are abandoned

Q98: Last year,Sarah (who files as single)had silverware