Multiple Choice

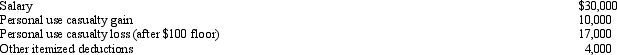

In 2012,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Definitions:

Related Questions

Q1: Paul and Patty Black are married and

Q30: Heather's interest and gains on investments for

Q39: For tax purposes,"travel" is a broader classification

Q69: A use tax is imposed by:<br>A) The

Q76: George is employed by the Quality Appliance

Q93: ABC Corporation mails out its annual Christmas

Q105: A moving expense deduction is allowed even

Q113: State and local governments are sometimes forced

Q119: Tired of renting,Dr.Smith buys the academic robes

Q122: Tim and Janet were divorced.Their only marital