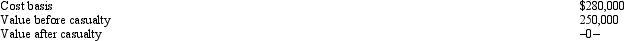

In 2012,Grant's personal residence was damaged by fire.Grant was insured for 90% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:  What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?

Definitions:

1040 Tax Form

The standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns.

Real Estate Taxes

Taxes imposed on properties by local governments, calculated based on the assessed value of the property.

Taxable Income

Income that is subject to taxes, typically calculated by deducting deductions and exemptions from gross income.

Tax Schedule

Detailed tax documents filed with the IRS to report certain types of income, deductions, or credits.

Q8: After graduating from college,Clint obtained employment in

Q20: For self-employed taxpayers,travel expenses are not subject

Q21: Steve and Holly have the following items

Q29: The amount of a taxpayer's itemized deductions

Q50: When stock is sold after the record

Q51: A worker may prefer to be treated

Q56: Martha rents part of her personal residence

Q79: "Other casualty" means casualties similar to those

Q111: Depreciation on a building used for research

Q120: Provisions in the tax law that promote