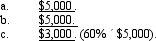

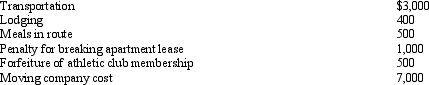

After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in Baltimore to Omaha,Clint incurred the following expenses:

Definitions:

Market Value

The price at which assets or services are currently being exchanged in the marketplace.

Accumulated Depreciation

The total amount of a company's asset value that has been expensed as depreciation since the asset was acquired.

Accounts Receivable

Financial claims of a business against its customers for the provision of goods or services, which have not been paid for.

Partners' Equity

The ownership interest of partners in a partnership, representing their original investments plus any accumulated profits or minus any losses.

Q8: After graduating from college,Clint obtained employment in

Q11: Gary cashed in an insurance policy on

Q22: How are combined business/pleasure trips treated for

Q38: Marilyn is employed as an architect.For calendar

Q38: For real property,the ADS convention is the

Q53: Under a state inheritance tax,two heirs,a cousin

Q54: Janet is the CEO for Silver,Inc.,a closely

Q69: In 2012,Grant's personal residence was damaged by

Q96: The basis of an asset on which

Q111: Calculate the net income includible in taxable