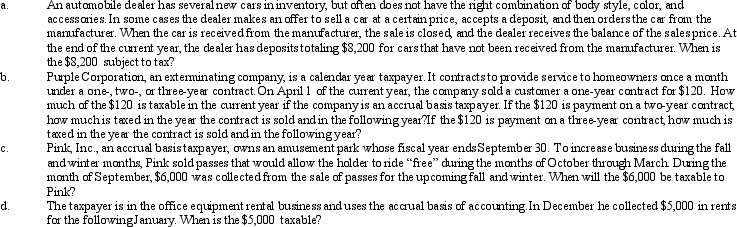

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Communication Patterns

The habitual ways in which individuals exchange information, ideas, and feelings with others.

Listening Patterns

The habitual ways in which individuals process and respond to auditory information, reflecting their preferences and tendencies in communication.

Affective Constructions

Constructs relating to or involving emotions and feelings.

Anger-Sadness-Shame

Emotional states commonly explored in therapy, often related to personal conflicts, loss, or self-perception issues.

Q3: A corporation's election to forego a net

Q23: Taxpayer's home was destroyed by a storm

Q54: In 2011,Robin Corporation incurred the following expenditures

Q64: Trade of business expenses are classified as

Q91: Gain on the sale of collectibles held

Q92: For income tax purposes,excess capital losses of

Q92: Freddy purchased a certificate of deposit for

Q95: Sarah,a widow,is retired and receives $20,000 interest

Q98: Which of the following is not a

Q165: Jacob and Ashley form Junco Corporation with