Camilla and Dean form Grouse Corporation with the following investment:  Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Definitions:

Commons Dilemmas

Situations where individual interests conflict with the collective good, often leading to the overuse or depletion of shared resources.

Armed Conflicts

Instances of prolonged violence between national military forces, or between armed groups within a nation, often recognized by significant levels of aggression and organized combat.

Social Scientifically

Pertaining to the use of scientific methods and principles to analyze and understand social phenomena.

Social Dilemmas

Situations in which individual interests are in conflict with collective interests, leading to challenges in decision-making.

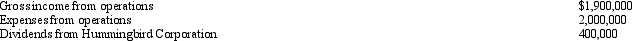

Q10: Carol had the following transactions during 2012:

Q14: Adjusted gross income (AGI)sets the ceiling or

Q14: Which publisher offers the United States Tax

Q21: Section 1231 property generally does not include

Q21: Harry and Wanda were married in Texas,a

Q40: April,a calendar year taxpayer,is a 40% partner

Q59: Which of the following statements,if any,is characteristic

Q60: Willie is the owner of vacant land

Q93: Robin Construction Company began a long-term contract

Q101: Sharon made a $60,000 interest-free loan to