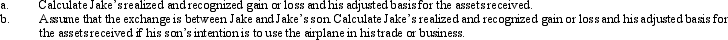

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Generalized Anxiety Disorder

A chronic condition characterized by excessive and persistent worrying about various aspects of life, often without a specific cause.

Body Dysmorphic Disorder

A mental disorder involving obsessive focus on a perceived flaw in appearance, often leading to significant distress and impaired functioning.

Agoraphobia

An anxiety disorder characterized by an intense fear of being in places where escape might be difficult or help might not be available, often leading to avoidance behaviors.

Obsessive-Compulsive Disorder

A mental health condition characterized by unwanted, repetitive thoughts and behaviors that the person feels the need to perform.

Q3: The tax law requires that capital gains

Q20: David earned investment income of $20,000,incurred investment

Q33: Discuss the advantages and disadvantages of the

Q33: Yvonne exercises incentive stock options (ISOs)for 100

Q44: A personal use property casualty loss is

Q55: Individuals who are not professional real estate

Q61: Which of the following statements is correct?<br>A)

Q64: Molly exchanges a small machine (adjusted basis

Q81: Group term life insurance is considered to

Q136: The nonrecognition of gains and losses under