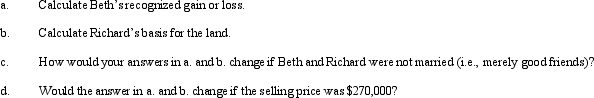

Beth sells investment land (adjusted basis of $225,000)that she has owned for 6 years to her husband,Richard,for its fair market value of $195,000.

Definitions:

Bad Debts Expense

The cost associated with accounts receivable that a company is unable to collect, considered an expense on the income statement.

Note Receivable

A financial asset representing a promise to receive a specific amount of money in the future, often with interest.

Receipt

A written acknowledgment that something of value has been transferred from one party to another.

Factoring Fee

The cost charged by a third party to a business for providing factoring services—financing based on the business's receivables.

Q1: Compare a § 401(k)plan with an IRA.

Q10: In 2012,Beth sold equipment used in her

Q14: Qualified rehabilitation expenditures include the cost of

Q21: Which statement is incorrect with respect to

Q23: Melvin receives stock as a gift from

Q35: Short-term capital losses are netted against long-term

Q41: Cason is filing as single and has

Q51: Pam exchanges a rental building,which has an

Q70: If the AMT base is greater than

Q75: Alex used the § 121 exclusion three