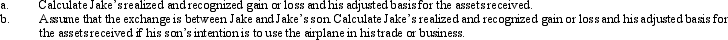

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Average Costs

The total costs divided by the total quantity produced, expressing the cost per unit of goods or services.

Transfer Price

The price at which goods, services, or intellectual property are traded between divisions within the same organization.

Market Price

The current price at which a good or service can be bought or sold in a marketplace.

Marginal Cost

The change in total cost that arises when the quantity produced is incremented by one unit.

Q6: The chart below describes the § 1231

Q21: Which statement is incorrect with respect to

Q29: A researcher can find tax information on

Q38: In order to qualify for like-kind exchange

Q39: Which,if any,of the following correctly describes the

Q43: Prior to the effect of tax credits,Wayne's

Q45: Jack owns a 10% interest in a

Q50: Stuart is the sole owner and a

Q66: Which of the following correctly reflects current

Q77: Rex and Dena are married and have