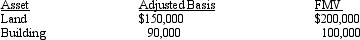

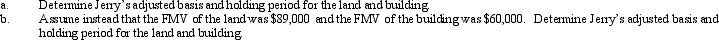

On September 18,2012,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2009,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Low Self-efficacy

The belief in one's inability to achieve goals or handle situations effectively.

Reiss Profile

A psychological tool that identifies the underlying motivations and needs of individuals to help explain why people behave the way they do.

Basic Desires

Fundamental motivations or drives that influence human behavior and decision-making.

Curiosity

A strong desire to know or learn something, driving individuals to explore, investigate, and seek out new information or experiences.

Q29: George,a sculptor,has an elevator installed in his

Q50: Shari exchanges an office building in New

Q60: Ed and Cheryl have been married for

Q68: Siva operates a retail music store as

Q81: A taxpayer is considered to be a

Q94: Henrietta and Hollis have been married for

Q99: On October 2,2012,Ross quits his job with

Q107: Amber is in the process this year

Q120: What is the easiest way for a

Q141: The adjusted basis of property that is