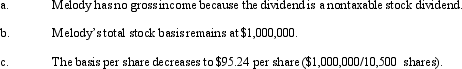

Inez's adjusted basis for 9,000 shares of Cardinal,Inc.common stock is $900,000.During the year,she receives a 5% stock dividend that is a nontaxable stock dividend.

Definitions:

Autonomic Arousal

The activation of the autonomic nervous system, which regulates involuntary body functions and responds to stress.

Conscious Experience

The awareness of internal or external existence, encompassing thoughts, feelings, and sensations.

General Bodily Arousal

A state of physical and psychological alertness, typically involving increased heart rate and energy, often as a response to stimuli or stress.

Specific Emotion

A distinct feeling that arises in response to a particular event or circumstance, identifiable by its unique psychological and physiological patterns.

Q7: On January 18,2011,Martha purchased 200 shares of

Q9: Section 1245 depreciation recapture potential does not

Q12: A net short-term capital loss first offsets

Q15: Prior to the effect of the tax

Q23: Certain situations exist where the wage-bracket table

Q36: The purpose of the work opportunity tax

Q50: During the year,Purple Corporation (a U.S.Corporation)has U.S.-source

Q71: Mike's basis in his stock in Tan

Q79: Agnes,a calendar year taxpayer,lists her principal residence

Q121: Discuss the relationship between realized gain and