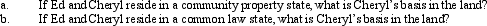

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012,when the fair market value of the land is $500,000.Under the joint ownership arrangement,the land passed to Cheryl.

Definitions:

Income Tax

A tax imposed by a government on the financial income generated by individuals or entities within its jurisdiction.

Plant Capacity

The maximum level of output that a company can sustain to produce in a given period under normal conditions.

Opportunity Cost

The cost of foregoing the next best alternative when making a decision, representing the benefits one misses out on when choosing one option over another.

Sunk Cost

A cost that has already been incurred and cannot be recovered.

Q8: Mary Jane participates for 100 hours during

Q32: Melissa,age 58,marries Arnold,age 50,on June 1,2012.Melissa decides

Q46: For purposes of computing the deduction for

Q46: Judith (now 37 years old)owns a collection

Q71: Kenton has investments in two passive activities.Activity

Q75: In the case of a taxpayer who

Q88: In determining the amount of the AMT

Q100: An expatriate who works in a country

Q101: In 2012,Cashmere Construction Company enters into a

Q154: Albert purchased a tract of land for