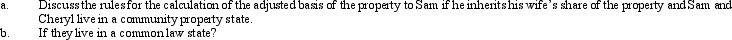

Sam and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $400,000 and a fair market value of $500,000.

Definitions:

Enlarged Ventricles

A condition where the chambers of the heart or brain (ventricles) are increased in size, which can impair their function.

MRI

Magnetic Resonance Imaging, a non-invasive medical imaging technique used to visualize detailed internal structures of the body.

Neural Damage

Injury to nerve cells or neural tissue, often resulting in loss of function or neurological deficits.

Schizophrenia

A mental disorder characterized by abnormal behavior, strange speech, and a decreased ability to understand reality.

Q4: The tax benefits resulting from tax credits

Q13: The holding period of replacement property where

Q23: Under a state inheritance tax,two heirs,a cousin

Q59: Discuss the relationship between the postponement of

Q66: The adjusted basis for a taxable bond

Q70: Last year,Wanda gave her daughter a passive

Q85: Can AMT adjustments and preferences be both

Q106: Robert sold his ranch which was his

Q116: A taxpayer who meets the age requirement

Q121: Tad and Audria,who are married filing a