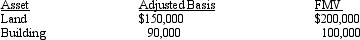

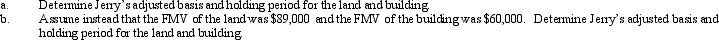

On September 18,2012,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2009,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Escape Learning

A form of learning in which an organism acquires a response to terminate an unpleasant stimulus, part of avoidance learning.

Punishment

A consequence delivered after an undesirable behavior, intended to decrease the likelihood of that behavior occurring in the future.

One Trial

A learning process that occurs after only a single exposure to a stimulus or event, leading to a change in behavior or knowledge.

Illness

A state of poor health, encompassing diverse types of diseases, disorders, and conditions.

Q2: If the fair market value of the

Q3: Explain how the sale of investment property

Q18: Which of the following statements is false?<br>A)

Q18: Jeanne had an accident while hiking on

Q38: Jenny spends 32 hours a week,50 weeks

Q41: Related-party installment sales include all of the

Q49: Vertigo,Inc.,has a 2012 net § 1231 loss

Q90: In 2005,Ross,who is single,purchased a personal residence

Q98: Cheryl is single,has one child (age 6),and

Q99: Wes's at-risk amount in a passive activity