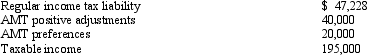

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.

Definitions:

Cataracts

A medical condition where the lens of the eye becomes progressively opaque, resulting in blurred vision and, if untreated, blindness.

Macular Degeneration

A medical condition that leads to vision loss, specifically in the macula portion of the retina, typically affecting older adults.

Visual Impairment

A condition characterized by the partial or complete loss of vision, which cannot be corrected with standard eyeglasses or contact lenses.

Presbyopia

A common age-related condition in which the eye gradually loses the ability to focus on nearby objects, typically starting around middle age.

Q1: Phillip developed hip problems and was unable

Q7: If property tax rates are not changed,the

Q20: David earned investment income of $20,000,incurred investment

Q43: Caroyl made a gift to Tim of

Q69: Larry was the holder of a patent

Q76: For individual taxpayers,the AMT credit is applicable

Q88: Which of the following is a typical

Q90: Ned,a college professor,owns a separate business (not

Q133: If a taxpayer purchases taxable bonds at

Q146: A parent employs his twin daughters,age 18,in