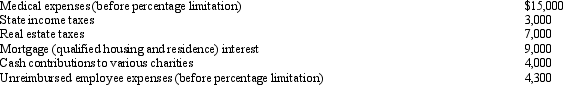

Mitch,who is single and has no dependents,had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

Definitions:

Repressed Memories

Memories involuntarily buried because they carry associations with significant stress or trauma.

Unconscious

The part of the mind that is inaccessible to the conscious mind but influences behaviors, thoughts, and feelings.

Universal Concepts

Ideas or understandings that are recognized and applied across different cultures and societies.

Free Association

A psychoanalytic technique in which a patient says whatever comes to mind in order to uncover subconscious thoughts and feelings.

Q1: Investment income can include gross income from

Q37: Lenny and Beverly have been married and

Q40: Even though an item of income is

Q42: A condemned office building owned and used

Q45: If an income tax return is not

Q101: Which of the following statements is incorrect?<br>A)

Q103: The calculation of FICA and the self-employment

Q134: If losses are disallowed in a related

Q135: Various tax provisions encourage the creation of

Q152: In connection with facilitating the function of