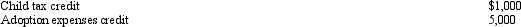

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Leaders

Individuals who guide, influence, or direct others towards achieving shared goals or objectives.

Corporate Philanthropy

The act of a corporation donating resources, including money, time, or products, to charitable causes to promote the welfare of others.

Social Impact

The effect an organization's actions have on the well-being of a community or society at large.

Corporate Leaders

Executives and high-level managers who have significant responsibility in guiding a corporation's strategy and operations.

Q9: John owns and operates a real estate

Q24: Leona borrows $100,000 from First National Bank

Q44: Donald owns a principal residence in Chicago,a

Q47: Broker's commissions,legal fees,and points paid by the

Q48: The AMT exemption for a C corporation

Q57: In 2012,Allison drove 800 miles to volunteer

Q63: On September 18,2012,Jerry received land and a

Q76: The low-income housing credit is available to

Q85: An employer calculates the amount of income

Q131: Both economic and social considerations can be