Cindy,who is single and has no dependents,has adjusted gross income of $50,000 in 2012.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

Definitions:

Crying Decline

The reduction in the frequency or duration of crying as an infant matures.

New Parents

are individuals who have recently become mothers or fathers, either through birth, adoption, or assuming a parenting role.

Weeks

Units of time that typically consist of seven consecutive days.

CNS

The central nervous system, comprising the brain and spinal cord, responsible for processing and transmitting neural signals in the body.

Q6: Tonya owns an interest in an activity

Q12: During the year,Green,Inc.,incurs the following research expenditures:

Q24: The American Opportunity credit is available per

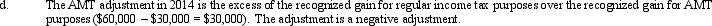

Q27: If the regular income tax deduction for

Q27: Last year,Ted invested $100,000 for a 50%

Q39: Match the treatment for the following types

Q50: Federal excise taxes that are no longer

Q61: Milt's building which houses his retail sporting

Q70: Joe,a cash basis taxpayer,took out a 12-month

Q104: To qualify for the § 121 exclusion,the