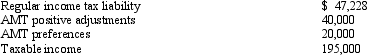

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.

Definitions:

Gave Birth

The act of delivering a baby or babies, concluding pregnancy.

Attachment Anxiety

A condition in which individuals feel significant anxiety about their relationships due to fears of abandonment or not being sufficiently close to others.

Friendships

Socially reciprocal relationships between two individuals, characterized by mutual affection, support, and a sense of belonging.

Young Adults

Individuals in a developmental stage spanning late adolescence to early adulthood, typically aged 18 to 25, experiencing significant life transitions.

Q1: Investment income can include gross income from

Q19: Emily,who lives in Indiana,volunteered to travel to

Q29: Nigel purchased a blending machine for $125,000

Q39: Ashley sells real property for $280,000.The buyer

Q43: Which,if any,of the following taxes are proportional

Q47: Broker's commissions,legal fees,and points paid by the

Q51: Taxes assessed for local benefits,such as a

Q53: The child tax credit is based on

Q81: A taxpayer is considered to be a

Q131: Larry,who lived in Maine,acquired a personal residence