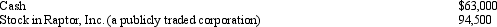

Marilyn is employed as an architect.For calendar year 2012,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Partial Inability

A condition where an individual or entity is limited in some capacity but is not completely incapacitated.

Performance Impracticable

A doctrine under which a party may be released from a contract due to the occurrence of unforeseen events making performance impossible or extremely burdensome.

Allocate Production

A business or economic strategy that involves distributing or assigning resources or production efforts in a specific way, often to maximize efficiency or meet certain goals.

Quality of Performance

A measure of the effectiveness and efficiency with which tasks or duties are executed, often evaluated against set standards.

Q8: Virginia had AGI of $100,000 in 2012.She

Q15: Kim dies owning a passive activity with

Q16: At the time of his death,Jason was

Q36: Sarah,who owns a 50% interest in a

Q43: The Zhong Trust is a calendar-year taxpayer.Its

Q76: The low-income housing credit is available to

Q100: An expatriate who works in a country

Q103: A gift to charity from its 2017

Q117: The additional Medicare taxes assessed on high-income

Q135: Faith inherits an undivided interest in a