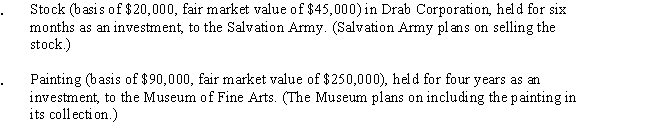

During the current year,Gray Corporation,a C corporation in the financial services business,made charitable contributions to qualified organizations as follows:

Gray Corporation's taxable income (before any charitable contribution deduction) is $1.8 million.

a.What is the total amount of Gray's charitable contributions for the year?

b.What is the amount of Gray's charitable contribution deduction in the current year, and what happens to any excess charitable contribution, if any?

Definitions:

Scheduled Appointment

An arranged meeting or commitment entered into a calendar or planner, often with reminders set to notify participants.

Period

A length or portion of time, often defined by specific start and end dates.

Days

Days refer to periods of 24 hours each, marking the time it takes for the Earth to complete one rotation on its axis.

Accompanying Figure

An illustrative diagram, chart, or image provided alongside text to enhance understanding or provide additional information.

Q4: Factors that can cause the adjusted basis

Q8: Assume a building is subject to §

Q37: A corporate net operating loss can be

Q52: A personal service corporation with taxable income

Q68: Juan,not a dealer in real property,sold land

Q87: What are the tax consequences if an

Q90: Darin,who is age 30,records itemized deductions in

Q142: Which of the following creates potential §

Q184: Interest received from municipal bonds in 2017.

Q187: The related-party loss limitation in a complete