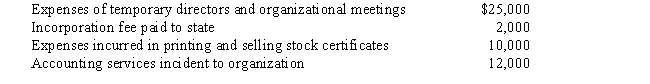

Warbler Corporation,an accrual method regular corporation,was formed and began operations on March 1,2017.The following expenses were incurred during its first year of operations (March 1 - December 31,2017):

a.Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2017?

a., except that Warbler also incurred in 2017 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2017 deduction for organizational expenditures?

b.Same as

Definitions:

Property Rights

Legal rights to use, control, and derive benefits from a property or resource.

International Businesses

Companies that operate across national borders, conducting sales, logistics, and management activities in multiple countries.

Country

A nation with its own government, occupying a specific territory.

Incumbent

An individual currently holding a particular position, often used in the context of political office.

Q6: In 2007,a medical doctor who incorporated his

Q20: Willie is the owner of vacant land

Q33: The adjusted gross estate of Keith,decedent,is $12

Q43: Warbler Corporation,an accrual method regular corporation,was formed

Q71: Theresa and Oliver,married filing jointly,and both over

Q76: Madge's tentative minimum tax (TMT) is $112,000.Her

Q78: Betty,a single taxpayer with no dependents,has the

Q85: Sand Corporation,a calendar year C corporation,reports alternative

Q89: In the current year,Oriole Corporation donated a

Q157: Gain realized,but not recognized,in a like-kind exchange