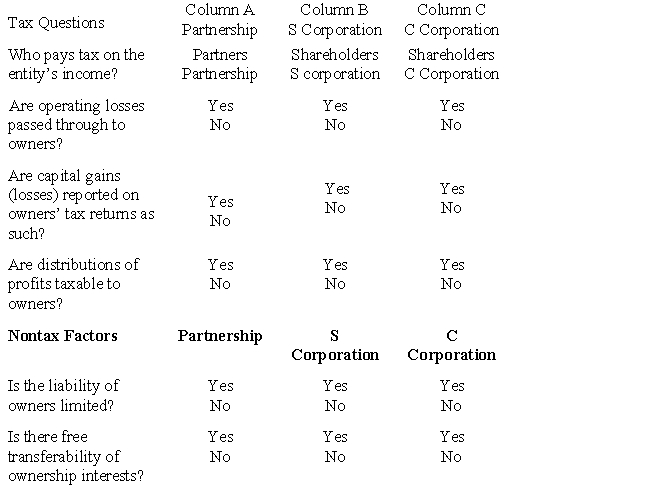

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Definitions:

Henry Murray

An American psychologist best known for his development of the Thematic Apperception Test (TAT) and for his theory of personality, which emphasized the role of needs.

Raymond Cattell

A psychologist known for his work in personality traits, factor analysis, and the development of several personality assessments.

Projective Test

A type of personality test in which the individual interprets ambiguous stimuli, revealing hidden emotions and internal conflicts.

Thematic Apperception Test

A projective psychological test that asks respondents to create stories about ambiguous scenes, used to uncover underlying motives, concerns, and how they see the social world.

Q20: Wendy sold property on the installment basis

Q27: Almond Corporation,a calendar year C corporation,had taxable

Q32: Reginald and Roland (Reginald's son) each own

Q66: Art,an unmarried individual,transfers property (basis of $130,000

Q83: Which of the following must use the

Q97: Caroline and Clint are married,have no dependents,and

Q102: For purposes of the waiver of the

Q102: In connection with the deduction for startup

Q112: At the beginning of the current year,Paul

Q143: The basis of property acquired in a