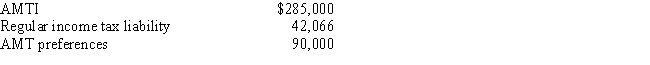

Caroline and Clint are married,have no dependents,and file a joint return in 2017.Use the following information to calculate their Federal income tax liability.

Definitions:

Jean-Martin Charcot

A French neurologist known for his work on hypnosis and hysteria, significantly influencing the development of neurology.

Carl Jung

A psychoanalyst and psychiatrist from Switzerland, the founder of analytical psychology, which stresses the value of one's own psyche and their journey towards being whole.

Hypnosis

A state of focused attention, reduced peripheral awareness, and an enhanced capacity for response to suggestion.

Projective Tests

Psychological assessments where individuals respond to ambiguous stimuli, revealing hidden emotions and internal conflicts.

Q20: Willie is the owner of vacant land

Q33: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q44: When depreciable property is transferred to a

Q46: In each of the following independent situations,determine

Q63: If boot is received in a §

Q66: A doctor's incorporated medical practice may end

Q78: During the current year,Quartz Corporation (a calendar

Q92: Eagle Corporation owns stock in Hawk Corporation

Q118: What requirements must be satisfied for a

Q259: Stuart owns land with an adjusted basis