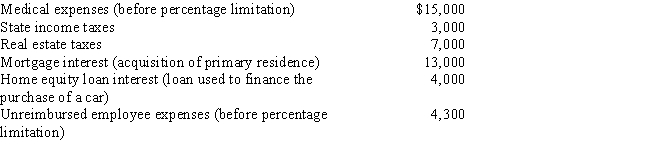

Mitch,who is single and age 46 and has no dependents,had AGI of $100,000 this year.His potential itemized deductions were as follows.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

Definitions:

Negative Message

Information conveyed that may be unwelcome, disappointing, or unfavorable to the receiver.

Shock

A sudden, often negative, emotional or physiological response to an unexpected event.

Negative News

Information or messages that convey unfavorable, bad, or depressing information, often requiring careful communication to minimize negative reactions.

Negative Messages

Communications that convey unfavorable, adverse, or otherwise negative information to the recipient.

Q11: Briefly describe the charitable contribution deduction rules

Q18: Similar to like-kind exchanges,the receipt of "boot"

Q31: On June 1,2017,Brady purchased an option to

Q38: The accrual method generally is required for

Q40: The installment method applies where a payment

Q97: Caroline and Clint are married,have no dependents,and

Q125: Prior to consideration of tax credits,Clarence's regular

Q145: Wade is a salesman for a real

Q239: If a taxpayer purchases a business and

Q264: Marilyn owns 100% of the stock of