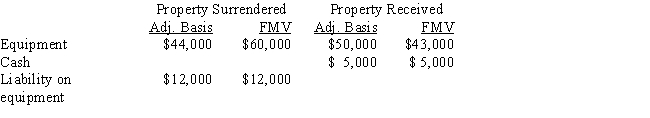

Sammy exchanges equipment used in his business in a like-kind exchange.The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Definitions:

Daily Basis

A period or measure referring to events or processes that occur or are calculated on a day-to-day basis.

Design Department

A division within a company responsible for developing new products or improving existing ones through research, planning, and design.

Labor Constraint

Is a restriction or limit within a production or project environment that pertains to the availability or efficiency of labor.

Weekly Basis

On a weekly basis indicates activities or measurements that occur or are evaluated every week.

Q1: For the current football season,Tern Corporation pays

Q32: Investment income can include gross income from

Q42: Alice owns land with an adjusted basis

Q50: Trent sells his personal residence to Chester

Q57: Noah gave $750 to a good friend

Q72: Copper Corporation sold machinery for $47,000 on

Q86: Roger owns and actively participates in the

Q92: Describe the general rules that limit the

Q118: A LIFO method is applied to general

Q160: The tax law specifically provides that a