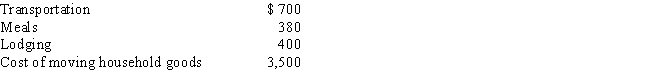

After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in Baltimore to Omaha,Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Twin Study

A research method used to study the genetic and environmental influences on traits by comparing the similarity between monozygotic (identical) and dizygotic (fraternal) twins.

Sternberg's Theory

This is Robert Sternberg's Triarchic Theory of Intelligence that suggests intelligence is comprised of three parts: analytical, creative, and practical intelligence.

Divergent Thinking

A cognitive process used to generate creative ideas by exploring many possible solutions and approaches in an open-ended way.

Concept

An abstract idea or a mental symbol that is typically used to denote a class of things, events, or phenomena.

Q2: Mike,single,age 31,had the following items for 2017:<br><br>

Q7: Ashley received a scholarship to be used

Q17: On February 20,2016,Bill purchased stock in Pink

Q38: In May 2017,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q104: Iris collected $150,000 on her deceased husband's

Q104: Child care payments to a relative are

Q105: For purposes of the § 267 loss

Q113: The de minimis fringe benefit:<br>A)Exclusion applies only

Q116: Ordinary and necessary business expenses,other than cost

Q244: Libby's principal residence is destroyed by a