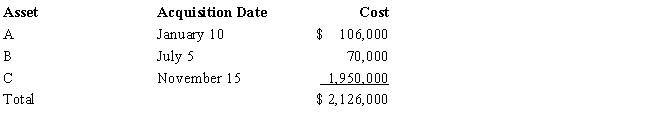

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra claims the full available additional first-year depreciation deduction.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Phonemic Rules

Guidelines that determine how phonemes, the basic units of sound in a language, can be combined to produce words and affect pronunciation.

Grammar

The set of rules that govern the structure and composition of phrases and sentences in a language.

Linguistic Relativity

A principle suggesting that the structure of a language affects its speakers' world view or cognition.

Audiograms

Graphical representations of an individual's hearing sensitivity for various frequencies.

Q2: Mike,single,age 31,had the following items for 2017:<br><br>

Q20: On June 2,2016,Fred's TV Sales sold Mark

Q24: Chris receives a gift of a passive

Q41: Your friend Scotty informs you that he

Q59: Discuss the tax consequences of listed property

Q64: Sandra sold 500 shares of Wren Corporation

Q83: Traditional IRA contributions made after an individual

Q89: Paula owns four separate activities.She elects not

Q95: Jordan performs services for Ryan.Which,if any,of the

Q103: Paul,a calendar year married taxpayer,files a joint