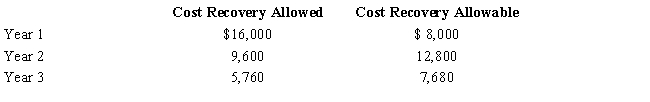

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are computed as follows.

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

Definitions:

Acceptance

The act of receiving or taking something offered, or the recognition of a new situation or condition without attempting to change it.

Hospice Care

Care provided for the dying in places devoted to those who are terminally ill.

Helping Profession

Careers dedicated to assisting individuals, families, groups, and communities in improving their well-being and resolving personal or societal problems.

Q8: Dena owns interests in five businesses and

Q33: Any § 179 expense amount that is

Q34: Kevin and Sue have two children,ages 8

Q39: Amber Machinery Company purchased a building from

Q47: Adam repairs power lines for the Egret

Q60: Raul is married and files a joint

Q72: Bonnie purchased a new business asset (five-year

Q87: Which of the following correctly describes the

Q123: Elsie lives and works in Detroit.She is

Q156: A taxpayer who uses the automatic mileage