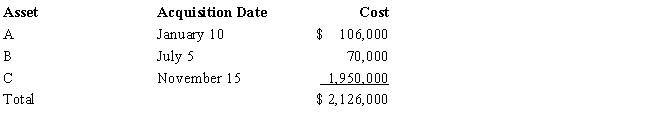

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra claims the full available additional first-year depreciation deduction.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Peripheral Devices

External devices connected to a computer that extend its capabilities, including printers, mice, and keyboards.

USB Port

A universal serial bus interface used to connect devices to a computer, facilitating communication and power supply.

Device Driver

Software that allows higher-level computer programs to interact with a hardware device.

Printer

A device that transfers text and graphics from a computer onto paper or other media, producing physical copies of digital documents.

Q15: In 2017,Morley,a single taxpayer,had an AGI of

Q17: In order to protect against rent increases

Q22: Jacob and Emily were co-owners of a

Q44: If the cost of uniforms is deductible,their

Q55: Ted was shopping for a new automobile.He

Q64: A taxpayer takes six clients to an

Q68: Audra acquires the following new five-year class

Q71: Aaron is a self-employed practical nurse who

Q75: Betty purchased an annuity for $24,000 in

Q126: Discuss the application of the "one-year rule"