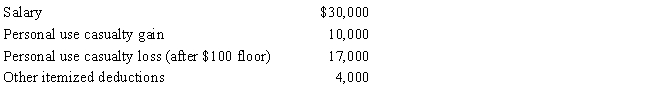

In 2017,Mary had the following items:

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for 2017.

Definitions:

Income Statement

A financial document that reports a company's financial performance over a specific period, including revenue, expenses, and net income.

Income Tax Expense

The total amount of income tax that a company is obliged to pay to tax authorities, based on its earnings.

Taxes Payable

The amount of tax liability a company or individual owes to a tax authority but has not yet paid.

Preferred Dividends

Preferred dividends are fixed dividend payments issued to preferred shareholders, prioritized over common stock dividends.

Q46: Judy is a cash basis attorney.In 2017,she

Q46: Felicia,a recent college graduate,is employed as an

Q63: Wayne owns a 30% interest in the

Q71: Alice purchased office furniture on September 20,2016,for

Q87: Which of the following items would be

Q102: Keogh (H.R.10) plans

Q111: George is employed by the Quality Appliance

Q147: For tax purposes,"travel" is a broader classification

Q178: Sue files a Form 2106 with her

Q181: After graduating from college,Clint obtained employment in