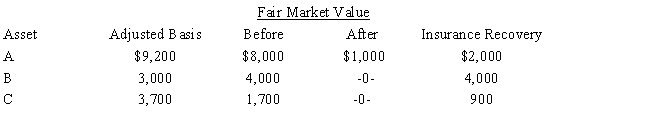

In 2017,Wally had the following insured personal casualty losses (arising from one casualty) .Wally also had $42,000 AGI for the year before considering the casualty.

Wally's casualty loss deduction is:

Definitions:

Owners

Individuals or entities that hold ownership in a company, possessing rights to its assets and profits.

Total Assets

The sum of all owned resources with economic value that are expected to provide future benefits to a business.

Statement Of Financial Position

A financial statement that shows the assets, liabilities, and equity of an entity at a specific point in time, providing a snapshot of its financial condition.

Statement Of Income

A financial report that shows a company's revenue, expenses, and profits over a specific period, often referred to as a profit and loss statement.

Q2: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q29: After the automatic mileage rate has been

Q63: In 2017,Tan Corporation incurred the following expenditures

Q64: Matilda works for a company with 1,000

Q66: Corey is the city sales manager for

Q74: All employees of United Company are covered

Q80: Maria,who is single,had the following items for

Q89: Roger is in the 35% marginal tax

Q90: Al contributed a painting to the Metropolitan

Q104: Brian makes gifts as follows:<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4136/.jpg"