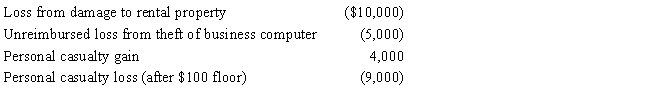

In 2017,Theo,an employee,had a salary of $30,000 and experienced the following losses:

Determine the amount of Theo's itemized deduction from these losses.

Definitions:

Endorphins

Natural pain-relieving peptides produced by the body that also promote feelings of pleasure and well-being.

Cortisol

A steroid hormone released by the adrenal glands in response to stress; plays roles in glucose metabolism, blood pressure regulation, and the immune response.

Serotonin

A neurotransmitter in the brain that regulates mood, appetite, and sleep, among other functions, often associated with feelings of well-being.

Personality

The combination of characteristics or qualities that form an individual's distinctive character, influencing their patterns of thought, feeling, and behavior.

Q4: In January 2018,Pam,a calendar year cash basis

Q5: When is a taxpayer's work assignment in

Q38: How does the taxation of Social Security

Q67: Norm's car,which he uses 100% for personal

Q88: Jose,single,had the following items for 2017:<br><br> <img

Q94: Land improvements are generally not eligible for

Q95: Meg's employer carries insurance on its employees

Q107: One of the tax advantages of being

Q118: Under the regular (actual expense) method,the portion

Q138: Madison is an instructor of fine arts