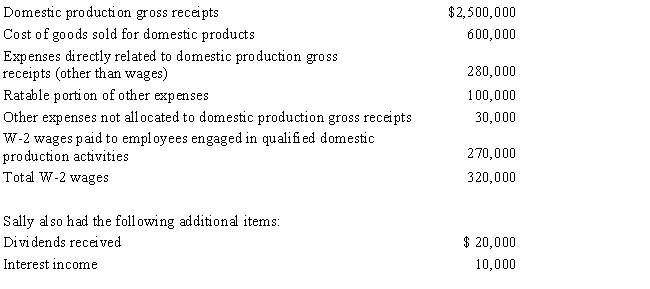

Red Company is a proprietorship owned by Sally,a single individual.Red manufactures and sells widgets.An examination of Red's records shows the following items for the current year:

Determine Sally's domestic production activities deduction for the current year.

Definitions:

C-O Bond

A covalent bond between a carbon atom and an oxygen atom, integral to many organic compounds and carbonates.

C-F Bond

The carbon-fluorine bond (C-F bond) is one of the strongest in organic chemistry, imparting chemical stability and resistance to various compounds.

Electronegativity Difference

The measure of the difference in electronegativity between two bonded atoms, influencing the bond type (ionic, polar covalent, or nonpolar covalent).

Organic Compounds

Chemical compounds that contain carbon and are found in living organisms, often forming the basis of chemistry related to life.

Q2: If a vacation home is classified as

Q6: Excess charitable contributions that come under the

Q25: If an account receivable written off during

Q27: Marsha is single,had gross income of $50,000,and

Q33: April,a calendar year taxpayer,is a 40% partner

Q38: If a taxpayer sells their § 1244

Q47: In December 2016,Mary collected the December 2016

Q53: In 2018,Rhonda received an insurance reimbursement for

Q65: For a taxpayer who is engaged in

Q99: In determining whether the gross income test