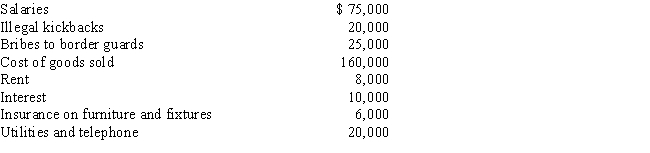

Tom operates an illegal drug-running operation and incurred the following expenses:

Which of the above amounts reduces his taxable income?

Definitions:

Receivables Turnover Ratio

A financial ratio indicating how efficiently a company collects on its accounts receivable, calculated as net credit sales divided by average accounts receivable.

Gross Accounts Receivable

The total amount of money owed to a company by its customers for goods or services delivered but not yet paid for, before any deductions for returns or bad debts.

Credit Sales

Credit sales refer to transactions where goods are sold and payment is allowed at a later date, extending credit to the buyer.

Current Ratio

A financial metric assessing a firm's capacity to settle short-term debts or obligations due within a year, determined by dividing current assets by current liabilities.

Q4: ABC Corporation declared a dividend for taxpayers

Q21: Linda borrowed $60,000 from her parents for

Q31: Calculate the net income includible in taxable

Q48: Sally is an employee of Blue Corporation.Last

Q64: Matilda works for a company with 1,000

Q71: A stepdaughter who does not live with

Q77: The cost of repairs to damaged property

Q86: On January 1,2017,an accrual basis taxpayer entered

Q93: Married taxpayers who file a joint return

Q120: If a vacation home is a personal/rental