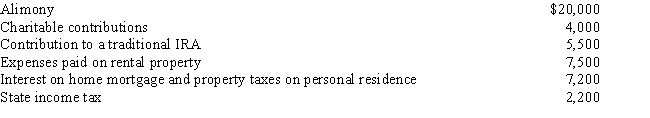

Al is single,age 60,and has gross income of $140,000.His deductible expenses are as follows:

What is Al's AGI?

Definitions:

Polygamist

An individual who is married to more than one spouse at the same time, a practice allowed in some cultures and religions but illegal in many countries.

White Settlers

Individuals of European descent who settled in lands outside Europe, often displacing indigenous populations, during periods of exploration and colonial expansion.

Indian Tribes

Indigenous peoples of the Americas, organized into societies or communities sharing common territories, customs, and cultural traits.

Peace Policy

An approach by governments or organizations towards achieving peace and resolving conflicts through diplomacy, negotiation, and nonviolent means.

Q7: During the current year,Ralph made the following

Q11: Jacob is a landscape architect who works

Q17: The alimony rules:<br>A)Are based on the principle

Q30: Several years ago,John purchased 2,000 shares of

Q31: Joseph and Sandra,married taxpayers,took out a mortgage

Q54: Are there any circumstances under which lobbying

Q57: Louise works in a foreign branch of

Q69: If an item such as property taxes

Q93: Brian,a self-employed individual,pays state income tax payments

Q102: A family friend who is supported by