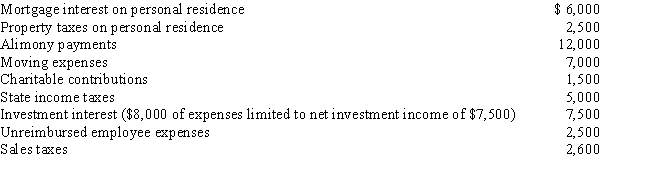

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Celebrity

A well-known individual, especially in entertainment or sports, who commands a significant degree of public fascination and influence.

Negative Reinforcement

A behavioral technique in which the removal of an undesirable or unpleasant stimulus following a behavior increases the likelihood of that behavior being repeated.

Wearout

The diminishing returns in effectiveness or impact of an advertisement or message over time due to repeated exposure, leading to boredom or annoyance in the audience.

Extinction

In behavioral psychology, the process by which a previously learned behavior decreases in frequency or disappears due to the removal of reinforcement.

Q7: During the current year,Ralph made the following

Q19: Gain on collectibles (held more than one

Q42: Which,if any,of the following expenses is subject

Q54: Tonya is a cash basis taxpayer.In 2017,she

Q93: Brian,a self-employed individual,pays state income tax payments

Q115: Beige,Inc.,an airline manufacturer,is conducting negotiations for the

Q124: Lois,who is single,received $9,000 of Social Security

Q164: The filing status of a taxpayer (e.g.,single,head

Q170: The work-related expenses of an independent contractor

Q185: Mr.Lee is a citizen and resident of