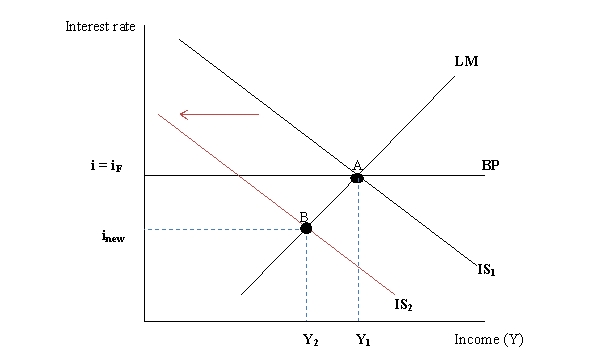

Figure 13.2

-Refer to Figure 13.2.In a fixed exchange rate regime,if an economy is experiencing external disequilibrium at point B,then to peg the exchange rate the central bank has to:

Definitions:

Capital Budgeting

The process of planning and evaluating investments in long-term assets, analyzing their expected cash flows and their impact on the company's financial future.

Bonds

Financial instruments representing a loan made by an investor to a borrower, typically corporate or governmental, where the issuer owes the holders a debt and is obliged to pay them interest and/or repay the principal at a later date, termed the maturity.

Issue Stock

This refers to the process by which a company offers new shares to investors or the public in order to raise capital.

NPV

Net Present Value, a method used in capital budgeting to evaluate the profitability of an investment or project by comparing the present value of cash inflows to the initial investment.

Q6: Which of the following is considered as

Q12: Assume that China and the U.S.are in

Q12: Refer to Table 9.1.The net present value

Q14: Currency plus commercial bank reserves held against

Q18: A currency is at a _ when

Q24: Assume that the one-month forward rate is

Q25: The real exchange rate is equal to

Q27: The following example supports which extension to

Q28: When the covariance of two assets is

Q53: The monetary approach states that,under a fixed