Designer Furniture began June with merchandise inventory of 45 sofas that cost a total of $31,500.During the month,Designer Furniture purchased and sold merchandise on account as follows:

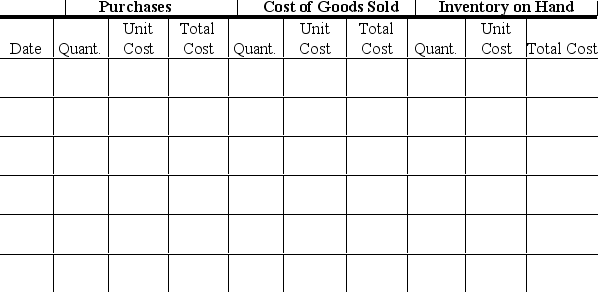

Prepare a perpetual inventory record,using the LIFO inventory costing method,and determine the company's cost of goods sold,ending merchandise inventory,and gross profit.

Definitions:

Marketable Stock Securities

Financial instruments that represent ownership in companies or rights to ownership, easily bought and sold in public markets.

Short-Term Investment

A short-term investment is an asset that is expected to be converted into cash or sold within a short period, typically one year, to generate income.

Unrealized Gains and Losses

Profits or losses that arise from changes in the value of investments or assets that have not yet been sold or realized.

Other Comprehensive Income

A component of shareholders' equity, consisting of income that is not realized and hence not included in the net income (loss), such as unrealized gains or losses on available-for-sale securities.

Q3: State the effects of inventory errors on

Q5: If the amount of the petty cash

Q43: Which of the following accounts will have

Q79: Which of the following is TRUE of

Q84: When a company uses the last-in,first-out (LIFO)method,the

Q102: Which of the following describes the risk

Q105: Adjusting entries are recorded in the _.<br>A)

Q132: Which of the following states that the

Q206: The operating cycle is the process by

Q251: When recording the sale of merchandise inventory,using