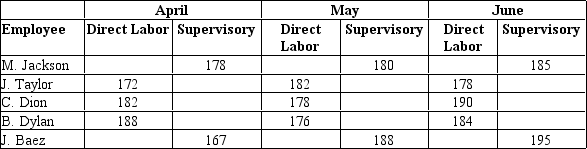

The Assembly Department of KEIA employs three direct laborers and two supervisory personnel.For the past several months,the employees have been assembling desks from pieces prepared in the Cutting Department.Three desks are expected to be produced for every labor hour incurred in the department.The hours worked in April,May,and June appear below.

Actual production of desks for April was 2,501; May,2,532; and June,2,601.

Actual production of desks for April was 2,501; May,2,532; and June,2,601.

a. Calculate the number of desks expected to be produced each month.

b. By what percentage did production fall short of expectations each month?

c. Comment on your calculations, and recommend what actions should be taken by the plant manager.

Definitions:

Form 941

A tax form used by employers to report quarterly federal payroll taxes, including amounts withheld from employees' paychecks and the employer's portion of social security and Medicare taxes.

Social Security

Government program that provides financial assistance to people with an inadequate or no income.

Medicare Taxes

Taxes collected from earnings to fund the Medicare program, providing health insurance to individuals aged 65 and older or those who meet specific criteria.

FUTA

The Federal Unemployment Tax Act, which imposes a payroll tax on businesses to fund state workforce agencies.

Q12: Management accounting complements each stage in the

Q15: When the cost-adjusted-to-market method is used to

Q22: Normal costing is the sum of actual

Q39: When a company holds U.S.Treasury bills,it would

Q64: Unit costs are determined by dividing the

Q65: Because it is invisible,direct labor cannot be

Q120: A corporation should account for the declaration

Q127: The income statement indicates a business's success

Q127: The objectivity standards of management accountants state

Q139: The primary purpose of the statement of