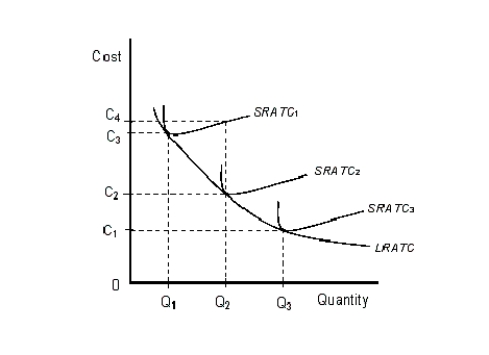

The figure given below shows three Short Run Average Total Cost (SRATC) curves and the Long Run Average Total Cost (LRATC) curve of a firm.Figure 8.3

-In the long run, if the output of a firm is zero then its total cost will be equal to its total fixed cost.

Definitions:

Logical Arguments

Reasoning formed through a sequence of statements or premises that lead logically to a conclusion.

Skeptical Audience

A group of individuals who are inclined to doubt or question the validity of the information presented to them.

Raw Data

Raw data are the unprocessed facts and figures collected from different sources that need analysis to make them meaningful.

Market Analysis

Market analysis involves the evaluation of a specific market within an industry, assessing its dynamics, trend, competition, and customer behavior to inform business strategies.

Q9: National economic policies are usually set by

Q11: If a 1 percent change in the

Q15: A trade deficit involves:<br>A)net flows of goods

Q31: Refer to Table 11.5. If marginal cost

Q39: Which of the following statements about health

Q42: From Table 8.2, derive the value of

Q64: Which of the following statements about marginal

Q90: According to neuroeconomists, the limbic portion of

Q91: If demand is relatively elastic and supply

Q120: Suppose Mark invests a sum of $100,000